All Categories

Featured

Table of Contents

Guaranteed global life, like whole life, does not expire as long as you purchase a plan that covers the rest of your life (life cover and funeral cover). You can purchase a plan that will cover you to age 121 for maximum protection, or to age 100, or to a more youthful age if you're attempting to save money and do not need protection after, say, age 90

Anything. An insured might have intended that it be utilized to pay for points like a funeral, flowers, medical costs, or assisted living home expenses. Nonetheless, the cash will belong to the beneficiary, that can choose to utilize it for something else, such as charge card financial obligation or a nest egg.

For an assured approval policy, they 'd pay $51. A 65 year-old man looking for a $10,000 face amount and no waiting period might pay concerning $54 per month, and $66 for guaranteed acceptance.

State Insurance Funeral Cover

If you have sufficient cash set apart to cover the expenses that have to be fulfilled after you pass away, then you do not require it. If you don't have money for these and various other associated expenditures, or routine insurance that might cover aid them, final cost insurance might be a real advantage to your household.

It can be made use of to spend for the different, standard services they want to have, such as a funeral service or memorial solution. Financial expenditure insurance policy is easy to get and economical - final expense insurance benefits. Coverage amounts variety from $2,000 approximately $35,000. It isn't a massive quantity yet the benefit can be a godsend for member of the family without the financial wherewithal to fulfill the expenses related to your passing.

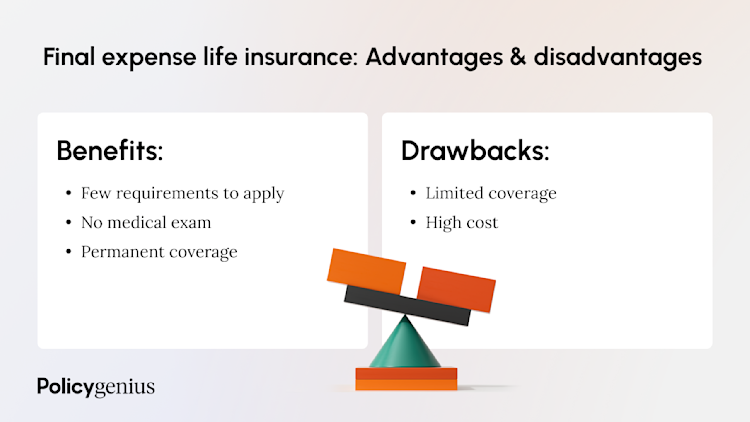

While numerous life insurance policy products require a medical examination, last cost insurance coverage does not. When obtaining last cost insurance coverage, all you need to do is respond to several questions regarding your wellness. 2 With final expense insurance policy, costs are secured in once you get accepted. 3 They'll never ever enhance as long as your plan stays active.

American Funeral Plan

This implies that a particular amount of time should pass in the past advantages are paid out. If you're older and not in the most effective health, you may notice greater premiums for last expense insurance coverage. You may be able to find even more cost effective protection with an additional kind of plan. Before you devote to a final expense insurance coverage policy, take into consideration these factors: Are you simply looking to cover your funeral service and burial expenses? Do you intend to leave your loved ones with some money to pay for end-of-life prices? If so, last cost insurance is likely a great fit.

If you would certainly like sufficient coverage without damaging the bank, final expenditure insurance policy may be worthwhile. If you're not in excellent wellness, you might wish to skip the clinical examination to get life insurance policy coverage. In this instance, it might be clever to think about last expenditure insurance coverage. Last expense insurance can be an excellent way to help shield your loved ones with a small payout upon your fatality.

Final costs are the costs your family spends for your funeral or cremation, and for other points you might want during that time, like a gathering to celebrate your life. Although thinking regarding final expenditures can be hard, recognizing what they set you back and seeing to it you have a life insurance policy plan large sufficient to cover them can assist save your family a cost they may not be able to pay for

One choice is Funeral service Preplanning Insurance policy which allows you choose funeral products and solutions, and fund them with the acquisition of an insurance policy. One more alternative is Final Expenditure Insurance Coverage.

Funeral Policy For Over 80 Years

It is projected that in 2023, 34.5 percent of family members will choose interment and a higher percent of family members, 60.5 percent, will certainly choose cremation1 (top 10 funeral plans). It's approximated that by 2045 81.4 percent of households will select cremation2. One reason cremation is ending up being much more popular is that can be less costly than interment

Depending on what your or your household desire, things like interment stories, major markers or headstones, and caskets can increase the rate. There might additionally be costs in enhancement to the ones particularly for interment or cremation. They may include: Treatment the cost of traveling for family members and enjoyed ones so they can attend a service Provided dishes and other expenditures for a celebration of your life after the service Purchase of special clothing for the service When you have an excellent concept what your final expenditures will be, you can assist get ready for them with the right insurance coverage plan.

They are usually issued to candidates with several health problems or if the candidate is taking specific prescriptions. funeral expense plans. If the insured passes throughout this period, the recipient will usually receive every one of the premiums paid right into the policy plus a tiny added percentage. An additional final cost alternative offered by some life insurance policy companies are 10-year or 20-year plans that provide candidates the alternative of paying their plan in full within a particular time framework

One Life Final Expense

The most crucial point you can do is answer questions honestly when getting end-of-life insurance policy. Anything you withhold or hide can cause your benefit to be denied when your family requires it most (end of life insurance cost). Some people believe that since most last expenditure plans don't need a medical examination they can exist regarding their wellness and the insurance provider will certainly never ever understand

Share your last dreams with them also (what blossoms you might want, what flows you desire reviewed, tracks you want played, and so on). Documenting these beforehand will certainly save your enjoyed ones a great deal of stress and will certainly avoid them from attempting to think what you wanted. Funeral expenses are climbing constantly and your health and wellness can transform unexpectedly as you grow older.

The key recipient obtains 100% of the death benefit when the insured dies. If the primary beneficiary passes before the insured, the contingent receives the benefit.

Best Burial Insurance Policies

It's important to periodically assess your beneficiary info to make sure it's updated. Always notify your life insurance coverage firm of any type of change of address or phone number so they can upgrade their records.

The death benefit is paid to the main recipient once the case is accepted. It depends upon the insurer. The majority of individuals can get protection until they turn 85. There are some companies that insure someone over the age of 85, yet be prepared to pay a really high premium.

If you do any kind of type of funeral planning beforehand, you can record your final long for your primary recipient and demonstrate how much of the plan advantage you wish to go in the direction of last plans. funeral scheme underwriters. The procedure is usually the very same at every age. The majority of insurer call for a private be at the very least 30 days old to make an application for life insurance policy

Some companies can take weeks or months to pay the policy benefit. Others, like Lincoln Heritage, pay approved cases in 24 hr. It's hard to say what the ordinary premium will certainly be. Your insurance policy rate depends upon your health and wellness, age, sex, and how much insurance coverage you're obtaining. A great estimate is anywhere from $40-$60 a month for a $5,000 $10,000 policy.

Table of Contents

Latest Posts

Insurance Policy To Cover Funeral Expenses

Buy Burial Insurance

Burial Cover

More

Latest Posts

Insurance Policy To Cover Funeral Expenses

Buy Burial Insurance

Burial Cover